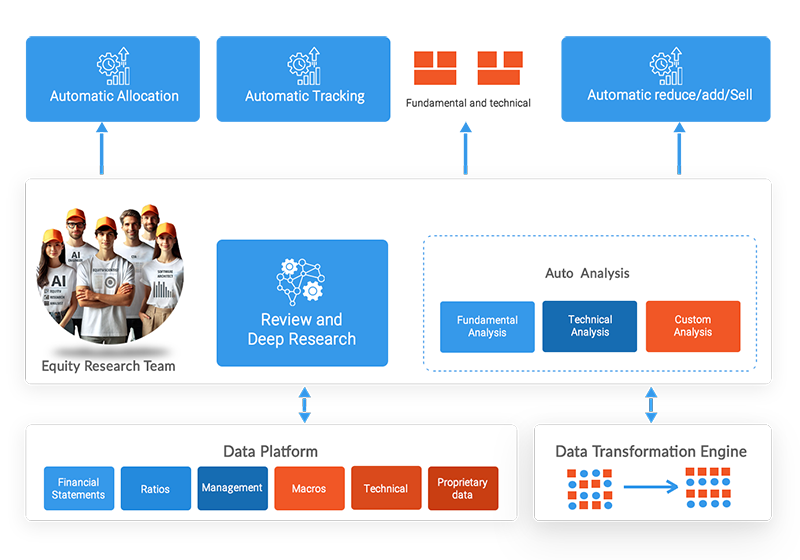

Invest Vidhi platform uses

power of software programming and AI capabilities to manage end to end equity research and execution process. The platform rates all listed companies based on macros , fundamental , technical , moat , business potential and then takes investment decisions.

The process of buying, selling, averaging up, and averaging down is also managed by the platform.

The platform has

has delivered a CAGR of 29.6% over the last 11 years in a live environment and 24.5% in back

testing of 20 years in our long term investing strategy.

platform has given returns of 41.19% CAGR over last 5 years vs 29% of small cap index , 23% mid cap index and 18% for sensex

In IT sectors ,

the platform has delivered returns of 33.5% CAGR over the last 5 years vs IT index and top

IT focussed mutual funds.

Performance

| Duration | Absolute Return | XIRR | Small Cap index average annual returns | Mid Cap index average annual returns | Sensex average annual returns |

|---|---|---|---|---|---|

| Year till Date | 50.40% | 50.40% | 33% | 33% | 14.84% |

| 1 Year | 52.02% | 52.02% | 53.26% | 53% | 23.02% |

| 2 Year | 208.00% | 44.20% | 38% | 37% | 16.05% |

| 5 Year | 561.00% | 41.19% | 29.00% | 23.00% | 18.00% |

We aim to simplify investing process using the best practices and investing rules

embedded in the platform. The process centric approach helps in removing human bias and emotions during the execution.

As our own biggest customer, we currently manage our own money and do not manage other people's money or provide advisory services